About Autera

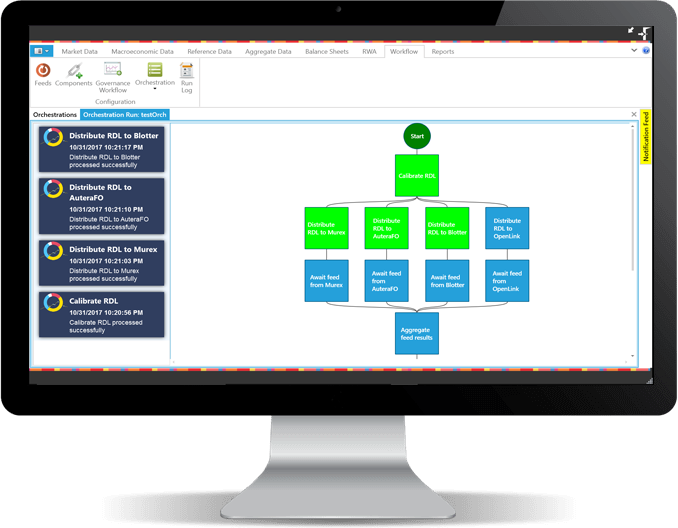

Autera provides solutions and services in the Capital Markets and Investment Banking space, with cutting edge technology and extensive domain expertise in Risk Management and Stress Testing. Autera's product suite covers Market Risk, Credit Risk, Stress Testing and customized bespoke solutions.

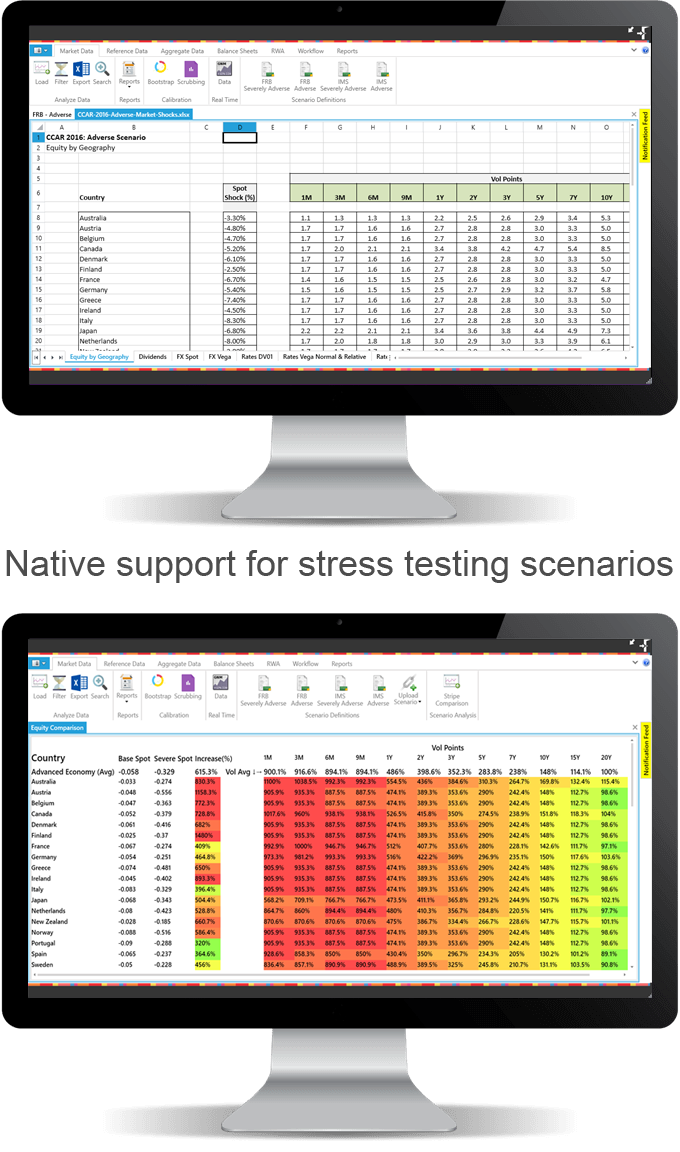

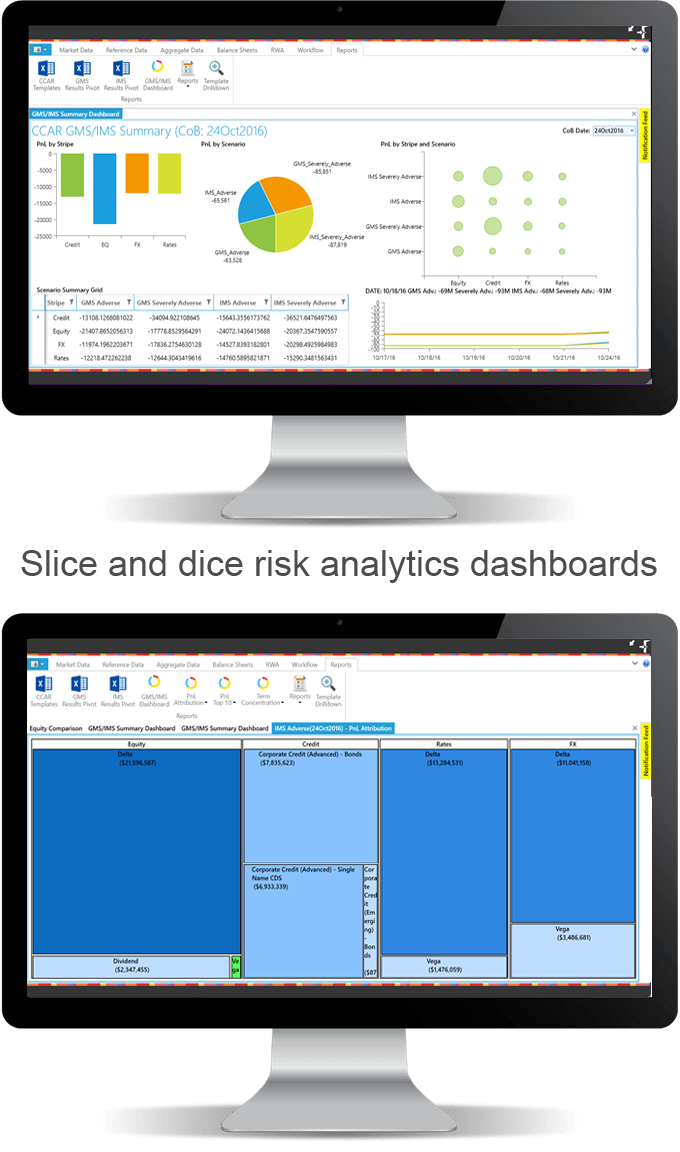

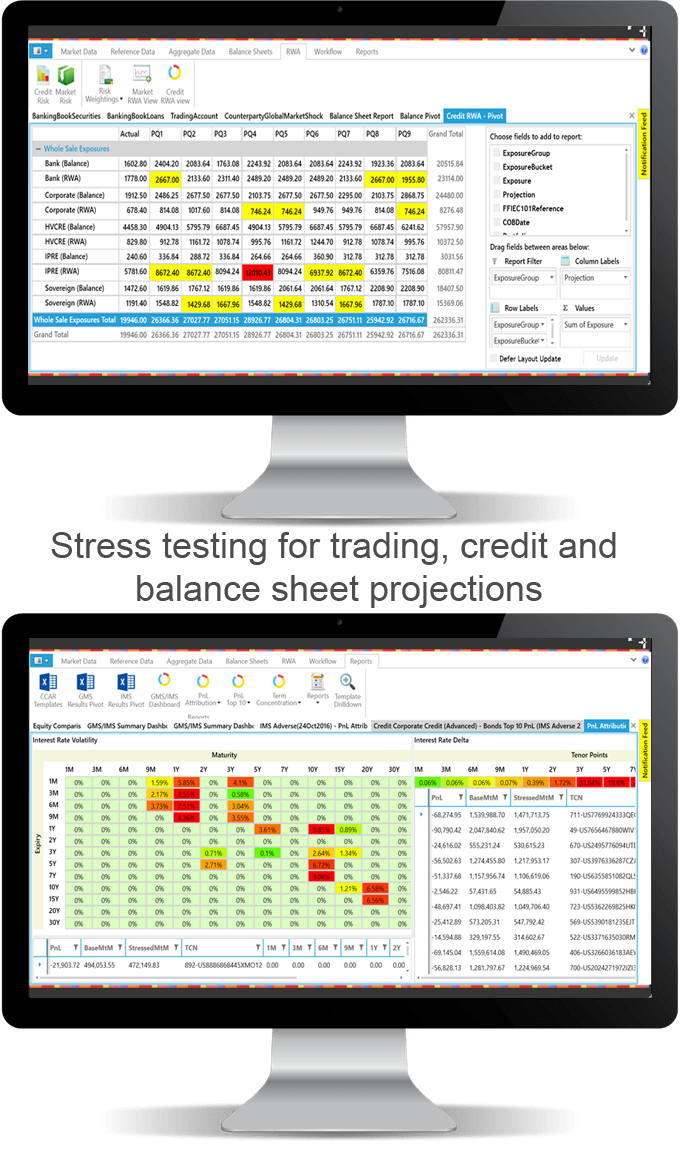

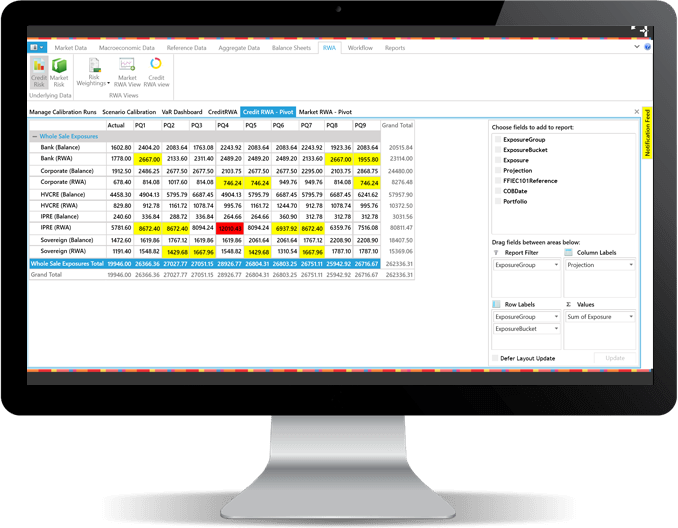

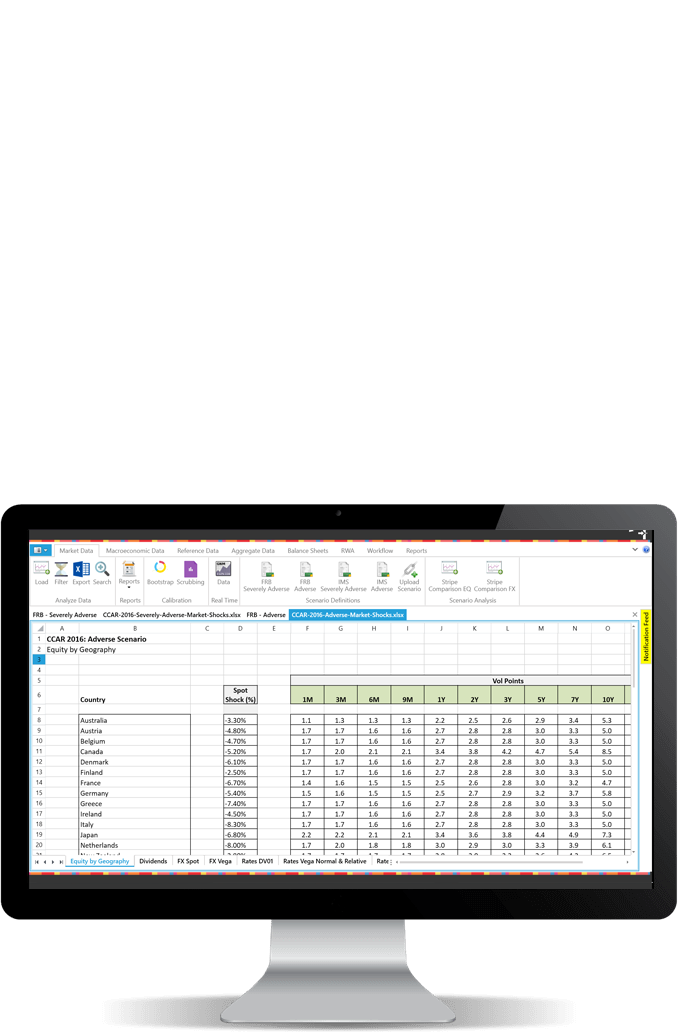

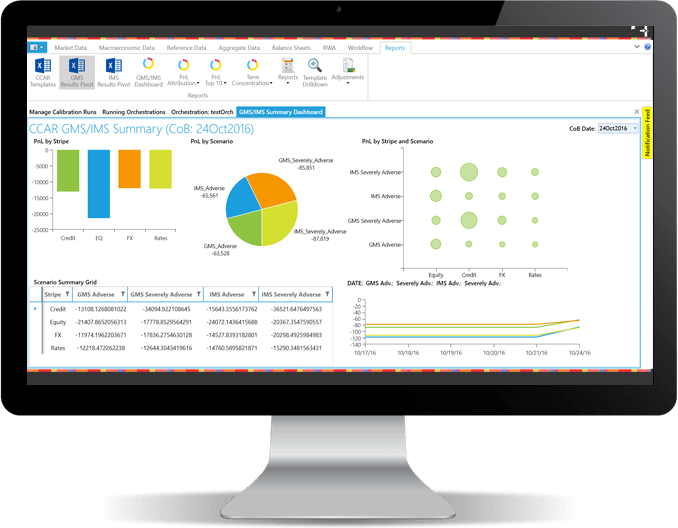

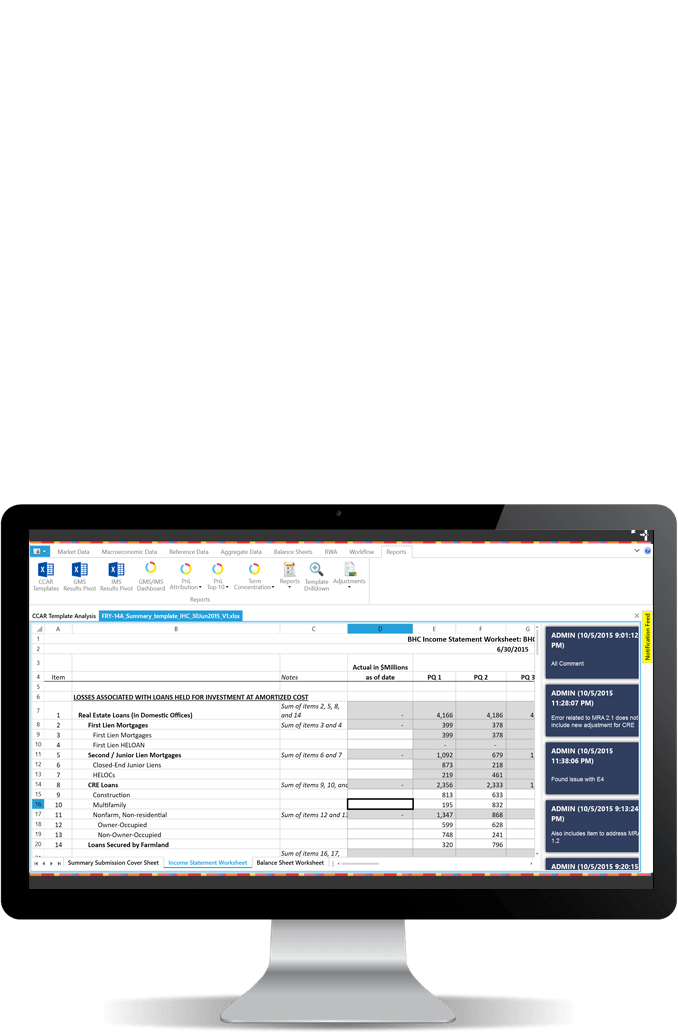

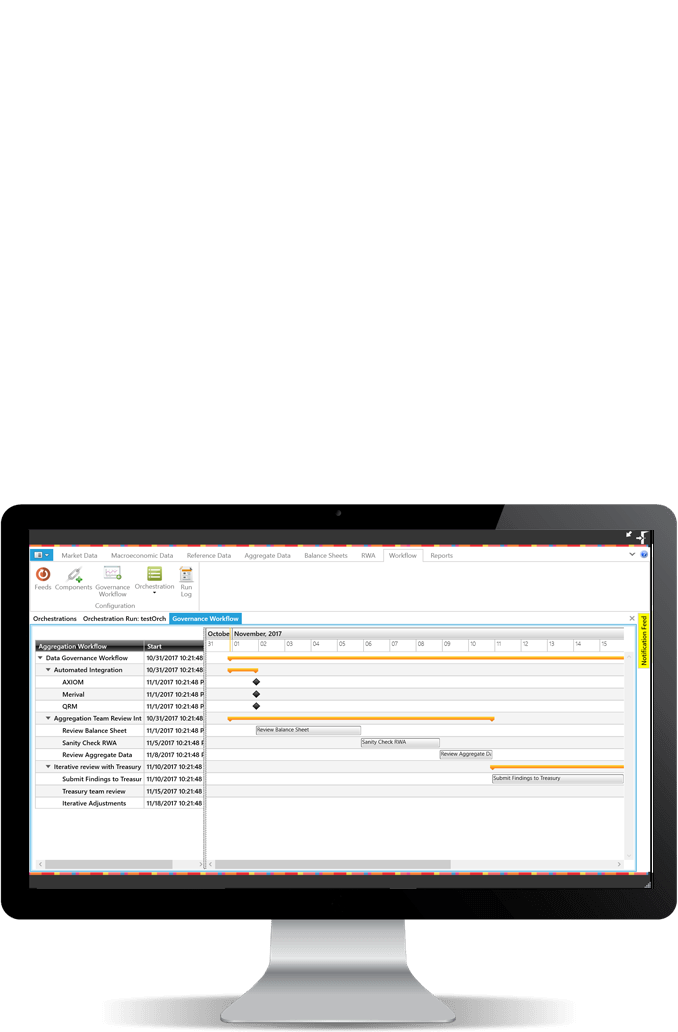

Stress Testing

Front-to-back stress testing capabilities for executing Global Market Shock and Macroeconomic scenario projections covered in US and European regulations such as CCAR/DFAST, PRA, EBA etc. Featuring a holistic approach to stressing Trading Risk, Counterparty Credit Risk, RWA and PPNR including Balance Sheet and Income Statement projection models.

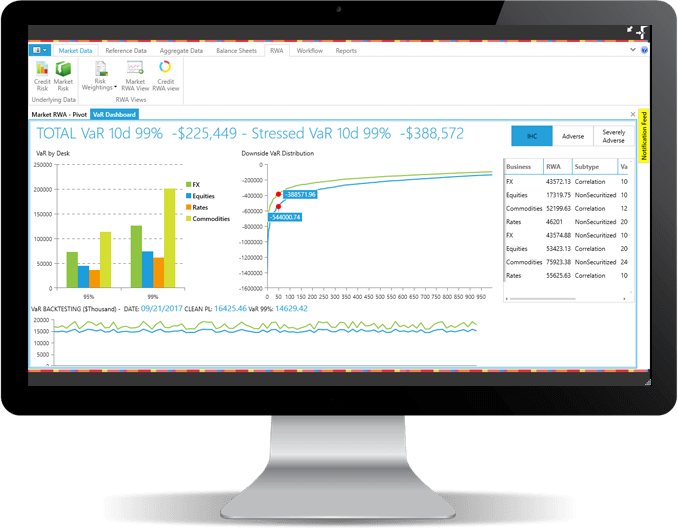

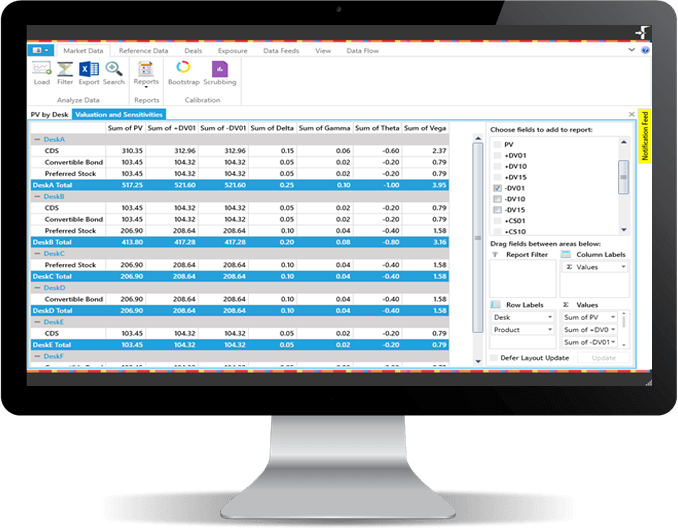

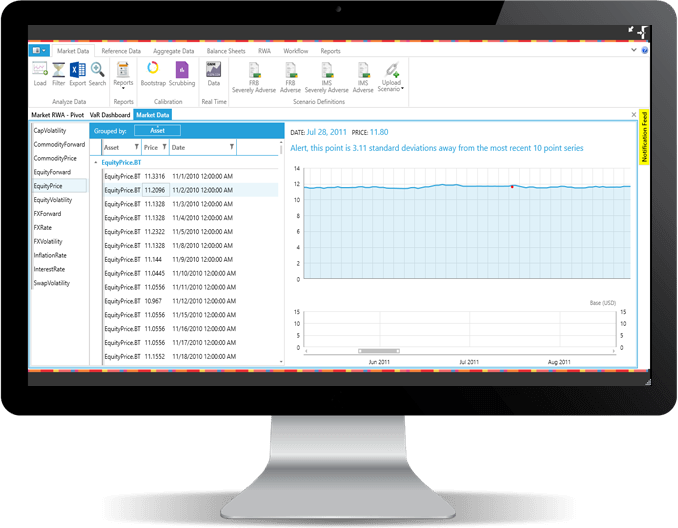

Market Risk

Powerful analytics for VaR, Expected Shortfall, Sensitivity Analysis and P&L Attribution. Featuring the Autera Quant Library with a wide breadth of product coverage for swaps and derivatives in the Rates, FX, Credit and Equity space.

Credit Risk

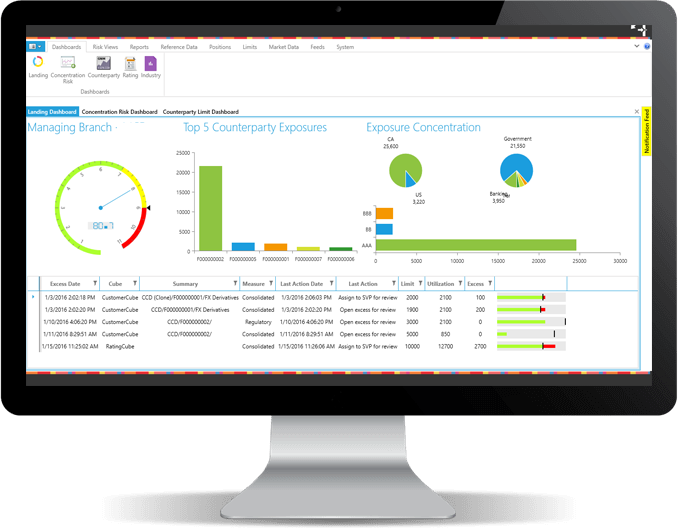

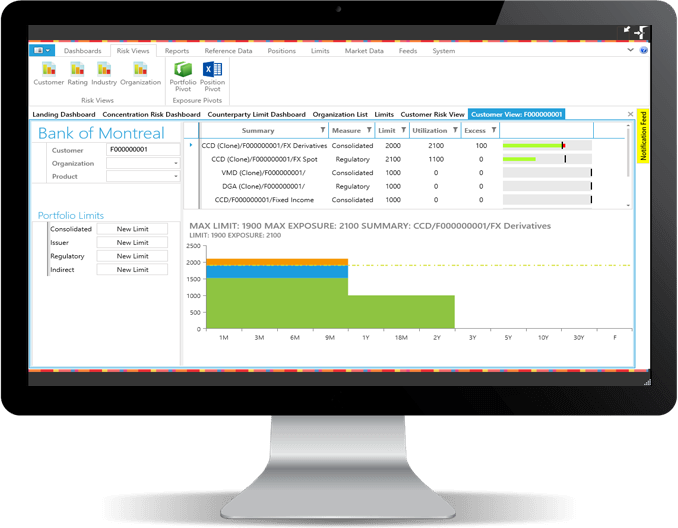

Real-time limit monitoring with What-if credit analytics capabilities, integrated counterparty netting and master netting agreements with configurable exposure roll-up as well real-time Dashboards that alert analysts to areas of concentrated risk.